Number of Beef Cattle in the Us

Chris Prevatt , UF/IFAS Beef Cattle and Provender Economist

The concluding several months take been exceptionally stressful for all participants in the U.S. cattle industry, due to the outbreak of COVID-19 (coronavirus) in Mainland china and its resulting spread throughout the world. The unknowns of this health crisis take resulted in extreme volatility in U.S. cattle markets. The entire U.S. cattle and beef supply chain has been impacted past COVID-19.

During late 2019 and early 2020, many forecasts were projecting higher U.Due south. cattle prices during 2020, relative to 2019. A combination of many factors (a plateauing U.Due south. cattle inventory, depression corn prices, low U.S. unemployment, stiff domestic and export beef demand, new trade agreements, etc.) supported the potential for higher U.Southward. cattle and beef prices. The improvement in cattle prices was well documented past Chicago Mercantile Substitution Live Cattle and Feeder Cattle Futures Contracts, USDA Agricultural Marketing Service, CattleFax, and Livestock Market Information Center'southward (LMIC) toll forecasts.

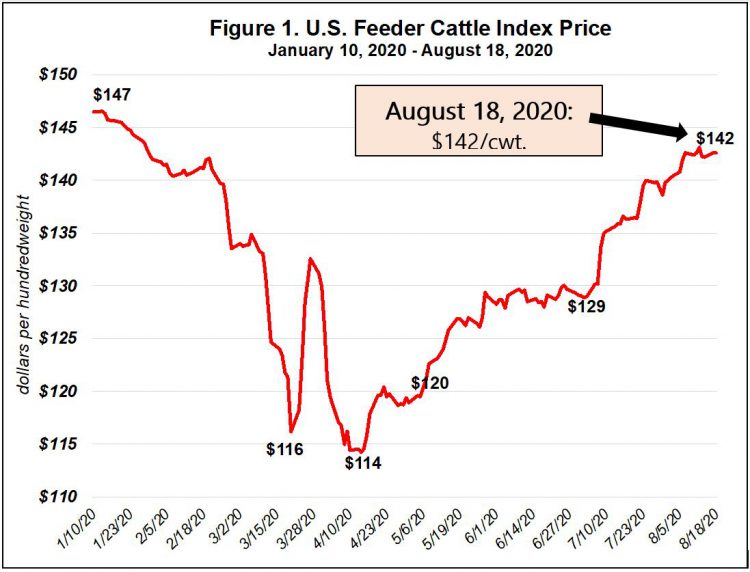

The U.S. Feeder Cattle Alphabetize Price, provided by the USDA's Agronomical Marketing Service, is developed from actual sales of feeder cattle via auctions, direct trade, video sales, likewise as net sales within the 12-land region of Colorado, Iowa, Kansas, Missouri, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Dakota, Texas, and Wyoming. These prices are a computed 7-day weighted average price, and provides a proxy for the current U.S. feeder cattle cash market, based on an 800-pound feeder steer. Effigy i shows the substantial decline and recovery of the U.S. Feeder Cattle Index Cost from January 10th to August 18th.

Thus far in 2020, the everyman U.S. Feeder Cattle Index Cost occurred on April 14th. On that date, feeder cattle prices for an 800-pound feeder steer had declined by $33 per hundredweight, or $264 per head from January 10th, when the crisis began impacting U.S. Beef Exports. For a load of 60 head of 800-pound feeder steers, that amounts to a decline of $15,840 per truckload unit. Since April 14th, U.Southward. Feeder Cattle Index Prices take improved by $28 per hundredweight, or $224 per caput. For a load of 60 head of 800-pound feeder steers, that amounts to an improvement of $13,440 per truckload unit. If evaluating the modify from January tenth to nowadays (August 18th), feeder cattle prices for an 800-pound feeder steer have declined $five per hundredweight or $40 per head. For a load of 60 head of 800-pound feeder steers, that amounts to a decline of $2,400 per truckload.

–

What would help Feeder Cattle Prices stabilize or ameliorate?

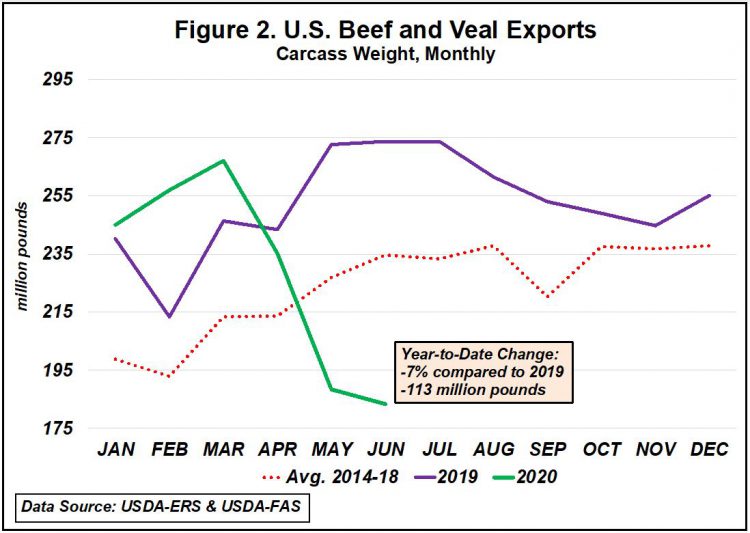

Domestic and global beef demand has been excellent the last several years. This was specially important given the huge supplies that were produced from the early on expansion years. Today, we are presented with a unlike claiming every bit nosotros still have huge supplies of cattle and beefiness in the U.South. supply concatenation for production in 2020 and 2021. Nonetheless, our consumers (domestically and globally) have reduced discretionary spending habits, compared to previous years, due to the impacts from the pandemic. Figure 2. provides a comparison of U.S. Beef and Veal Exports from 2020, 2019, and the v-year average of 2014 – 2018.

As you can see, U.S. Beef Exports take declined significantly since the pandemic started in March. When analyzing the data, there are twelvemonth-over year declines in beef export volumes to Nippon (-20.7), South Korea (-39%), Hong Kong (-11.2%), Taiwan (-37.2), Mexico (-61%), and Canada (-0.2%) for June 2020 compared to June 2019. It volition be extremely important for export volumes to ameliorate over the side by side several months, equally U.S. beef production increases during the third and fourth quarters.

Obviously, there are a number of major concerns given the current number of concern closings and the severity of unemployment so far in 2020. This will probable brand the consumer the driver of prices moving frontward. For U.S. cattle producers to run across an improvement in feeder cattle prices in the short run, there must be significant improvements in U.S. economic weather condition and consumer incomes. Additionally, where the product (beef) is sold is extremely important. Restaurant re-openings and improvements in seating chapters get a long way in helping to stabilize or improve prices. High-stop restaurants are peculiarly key in order for premiums to be for producers marketing beef cattle.

–

U.S. Economic Conditions

I'd like to briefly discuss five points in regard to the current U.Due south. economic weather.

- I think it'southward important for us to recollect that when " flatten the bend " was implemented in March/Apr 2020 this was to slow the spread of COVID-19. It was not expected to stop or reduce the overall spread or number of people who volition eventually become infected. The purpose was to avoid overwhelming medical resources until herd immunity, or a vaccine could be created. With that said, moving forward the same risks that were nowadays this Spring still be today.

- Anytime risk is high, nosotros should expect consumer goods to increase in price and raw products to pass up (assuming no meaning changes in supply and demand). Why? Because everyone assumes more take chances in the supply chain. Given, that 2020 has seen -$40/butt rough oil, a wellness pandemic, farthermost civil unrest in many cities, regime mandates to close down certain businesses, and a collapse in processing capacity in meat packing facilities, adventure is at a level that has not been seen in our lifetimes. No one in the supply chain wants to presume more than run a risk right at present for the aforementioned returns they were receiving prior to the pandemic.

- On July thirty, the U.S. Bureau of Economic Analysis officially confirmed that the U.Due south. Economy had entered into a recession. The official number for the second quarter growth rate for real gross domestic product (Gross domestic product) was – 32.9%. This comes after Real Gross domestic product decreased past five% during the 1st quarter of 2020. Neither during Corking Depression (1929–1933), nor the Dandy Recession (2008–2009) did such a decline in quarterly economic growth occur. The previous low-water market place was a -10% slide during the 1st Quarter of 1958.

- Data from Opentable.com provides some insights on the declines in sales at food and drinking services. The site reports information on seated diners from online, phone, and walk-in reservations. While restaurant dining plummeted to a almost 100% reduction in March and April, compared to 2019, a steady recovery from those spring lows has occurred. Data thru August eighteen, 2020 shows a 55% reduction in diners yr-to-date, when compared to 2019. Additionally, new data from the U.S. Demography Bureau indicates that nutrient and drinking services saw yr-to-date sales drib by 21.two% from 2019. This shows that while a recovery is occurring from the pandemic'due south darkest days thus far, nosotros are still nowhere near dorsum to normal.

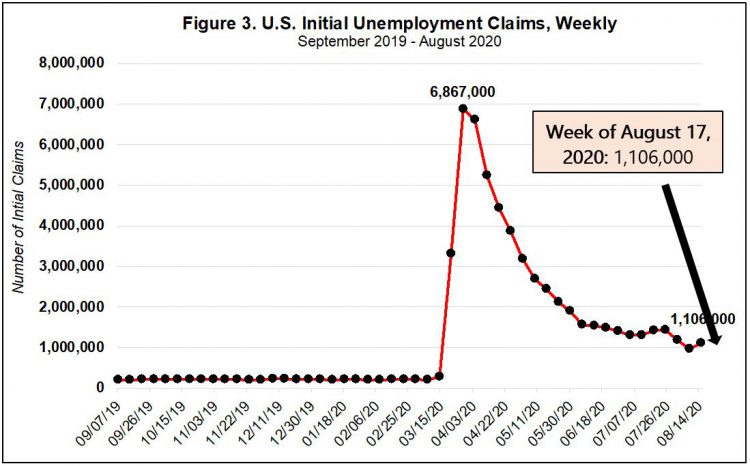

- Initial Unemployment Claims continue to increase each week at levels that can only be viewed past economists equally disastrous. An initial claim is a claim filed past an unemployed individual after a separation from an employer. The merits requests a determination of basic eligibility for the Unemployment Insurance program. Figure 3 below looks at U.S. weekly initial unemployment claims from September 2019 – August 2020.

–

–

A look back. To take a better understanding of the magnitude of current initial unemployment claims, at no betoken in time since the beginning of the drove of this data set in January 1967 has initial unemployment claims ever begun to approach the level of claims seen over the past 22 weeks. Prior to 2020, the highest weekly unemployment claim was 695,000 from the week of October 2, 1982. During " The Great Financial Crunch " (08/09 recession), initial unemployment claims peaked at 665,000 for the week of March 28, 2009. Since the week of March 21, 2020 initial unemployment claims accept exceeded 1,000,000 claims 21 times, while totaling 57,403,000 initial claims (in the last 22 weeks). While the stock market may accept had a V-shaped recovery from their lows in March, the data for the U.Due south. economy certain hasn't.

–

Lesser Line

COVID-19 has impacted every cattle operation in the United States. These cattle market impacts have resulted in substantial economic losses for many U.S. cattle producers. Many of these losses are ongoing and will probable go along through 2020. Regardless of when cattle producers market their livestock during 2020, they will likely receive significantly lower prices. Actual impacts volition certainly vary widely across operations. Producers should await markets to continue to be volatile, given our current set of circumstances and many unknowns. Abrupt changes and large cost swings in a COVID-19 marketplace may become the norm. Cattle producers who continue to search for means to lower their unit toll of product (what it costs to produce a pound of beef), and heighten the market prices they receive for their cattle will exist in a meliorate position when prices improve during the next decade.

- Writer

- Recent Posts

mcmilliancaravered44.blogspot.com

Source: https://nwdistrict.ifas.ufl.edu/phag/2020/08/21/the-2020-u-s-beef-cattle-market-and-current-economic-conditions/

0 Response to "Number of Beef Cattle in the Us"

Post a Comment